Overview

This Investment Property Record Keeping Spreadsheet can help up to 2 investors to keep track of up to 50 investment properties (rental expenses, income, etc).

You will get $79 FREE bonus (see the table below) when you purchase the Investment Property Record Keeping Spreadsheet.

| Free Bonus | Value |

|---|---|

| 1. Lifetime Free Update | $79 |

| Total Bonus | $79 |

Pay less if you DON'T need the bonus. Click here to learn how to pay less without bonus!

Try it now for free!

Download the Investment Property Record Keeping Spreadsheet trial here.

Please note: After the free trial period you will have to purchase an unlock code if you want to continue using the Investment Property Record Keeping Spreadsheet. The unlock code will turn the trial to the full version. Please understand the unlock code is NOT the password to unprotect the worksheet(s) or the file.

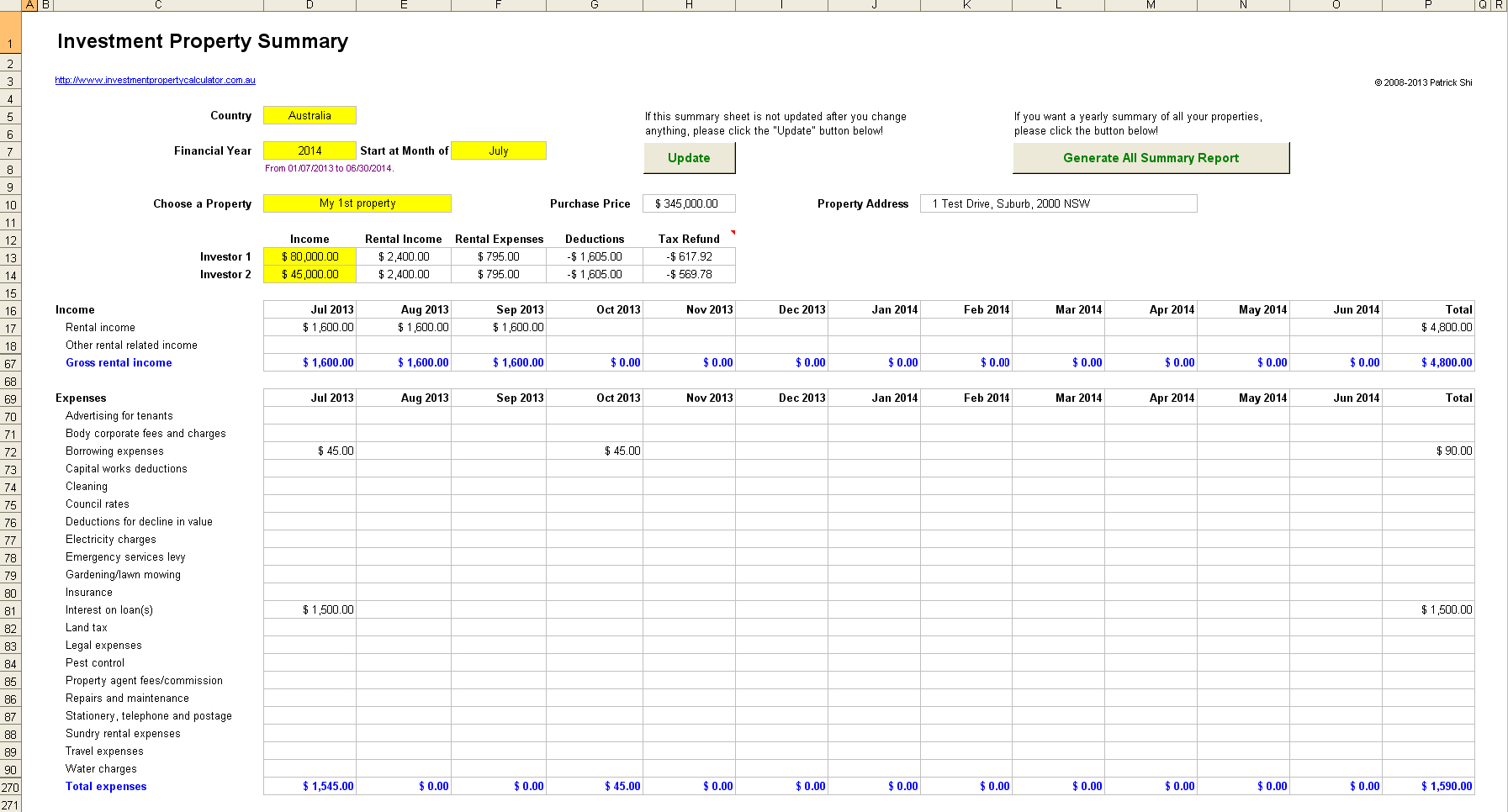

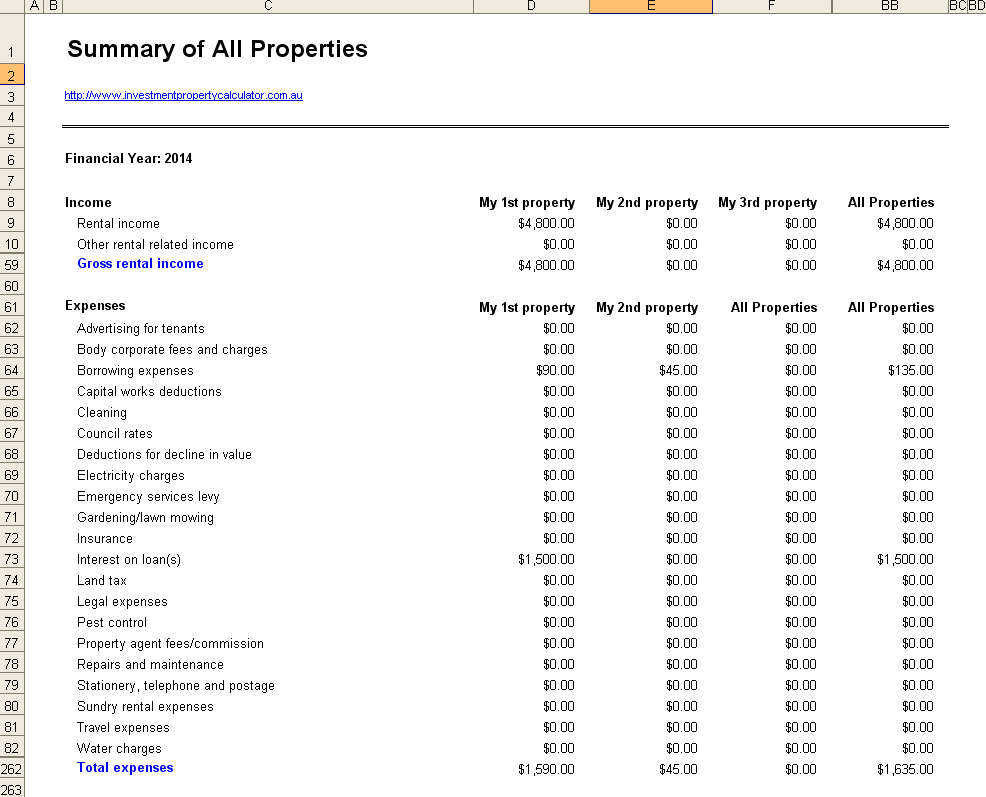

Here are some screenshots that will give you a better idea that what you need to do and what this Investment Property Record Keeping Spreadsheet can do for you.

Main Features

You don't have to pay for complicated accounting software or other technical software packages as now you can have this simple but powerful Investment Property Record Keeping Spreadsheet for a fraction of the cost you will normally pay. You can track all the income and expenses up to 50 rental properties on a monthly basis. It will estimate the tax deductions of individual properties as well as your property portfolio. It just makes rental property record keeping easy and simple!

Here is a list of features that this Investment Property Record Keeping Spreadsheet has.

1. Allows up to two (2) investors;

2. Allows to track up to 50 rental properties;

3. Allows to track up to 50 rental income items;

4. Allows to track up to 200 rental expense items;

5. Allows to track up to 15 years' rental records in one file;

6. Very simple information input interface;

7. Allows flexible start month for financial year so you can use it for calendar year as well;

8. Allows to set Australia tax rates or international tax rates;

9. Estimates tax deductions for individual properties as well as your property portfolio;

10. A dedicated worksheet for you to keep all your notes related to your rental properties;

11. A worksheet for you to see the details of all the inputs under any category;

12. A summary worksheet to show annual summary of each individual property and the total of all properties.

13. Allows you to record the initial purchase costs associated with your properties.

Things You Need to Know

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it. You need to enable Macro in Excel so this tool will work.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.