Overview

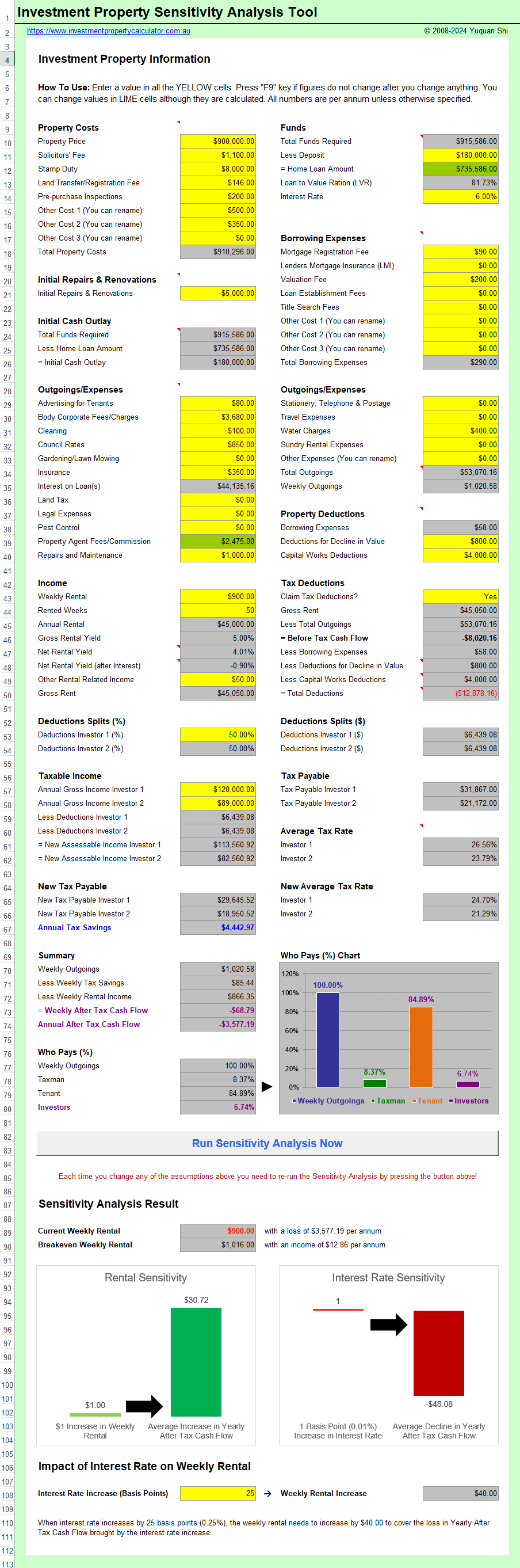

The Investment Property Sensitivity Analysis Tool is created for property investors to perform sensitivity analysis on interest rates and/or rental income so you can see where a break-even point or how much you will need to increase your weekly rental when the home loan interest rate goes up.

The Investment Property Sensitivity Analysis Tool is a financial modeling tool to helps property investors understand how changes in key factors like weekly rental income, interest rates, and rental expenses can affect the performance of their investment properties.

To conduct an effective sensitivity analysis, property investors can focus on several critical variables:

Weekly Rental Income: Changes in rental income can significantly impact your cash flow. Do you want to know much the after tax cash flow will increase if you increase the weekly rental by $1?

Interest Rates: Variations in interest rates can influence the mortgage payments and the after tax cash flow significantly. Do you want to know much the after tax cash flow will decrease if the home loan interest rate goes up by 1 basis point (i.e. 0.01%)?

Rental Expenses: Increases in maintenance, property management, or utility costs can reduce the after tax cash flow. Do you know how much you need to increase the weekly rental to break even if the Body Corporate Fees (strata) increase $800 per annum?

Here is a screenshot that shows what reports are provided in the Investment Property Sensitivity Analysis Tool.

Main Features

This Investment Property Sensitivity Analysis Tool caters for such variables as:

1. adjusting rental outgoings/expenses;

2. adjusting rented weeks & weekly rental income;

3. adjusting home loan amount;

4. adjusting home loan interest rate;

5. adjusting salary income (up to two investors);

6. setting Claim Tax Deductions or not;

Things You Need to Know

The Investment Property Sensitivity Analysis Tool can estimate one investment property and one PPOR property. If you plan to build a property portfolio by purchasing multiple investment properties over a time period, the Ultimate Investment Property Calculator Spreadsheet will be the most useful tool that can help you plan your long-term property investment activities although it does not include any rentvesting calculation.

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Important Assumptions

The Investment Property Sensitivity Analysis Tool has the following assumptions. Certain assumptions listed here can be adjusted by the users.

(1) It is assumed the investor has an interest only (unless otherwise stated) home loan and the interest is deductible for tax purposes.

(2) When calculating the tax payables, the tax rates applicable to Australian residents are used and the 2% Medicare Levy based on the individual Medicare Levy threshold is included where applicable. The calculator does not incorporate any other factors that might influence the amount of tax payable, such as Medicare levy surcharge, HECS contributions, any rebates, and deductions.

(3) It is assumed that the investors own the property as tenants in common (so they may hold unequal interests in the property) but not joint tenants (they each hold an equal interest in the property). Rental income and expenses are divided based on this assumption.

(4) All months are assumed to be of equal length. One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.

(5) All the properties are assumed to be purchased and owned by individual investor(s) instead of trust or company or organization (unless otherwise stated). If you plan to use the calculators for ownership other than individuals (unless otherwise stated) please do not purchase our calculators.

If you have any questions please contact us we will get back to you within one hour during working hours.