Overview

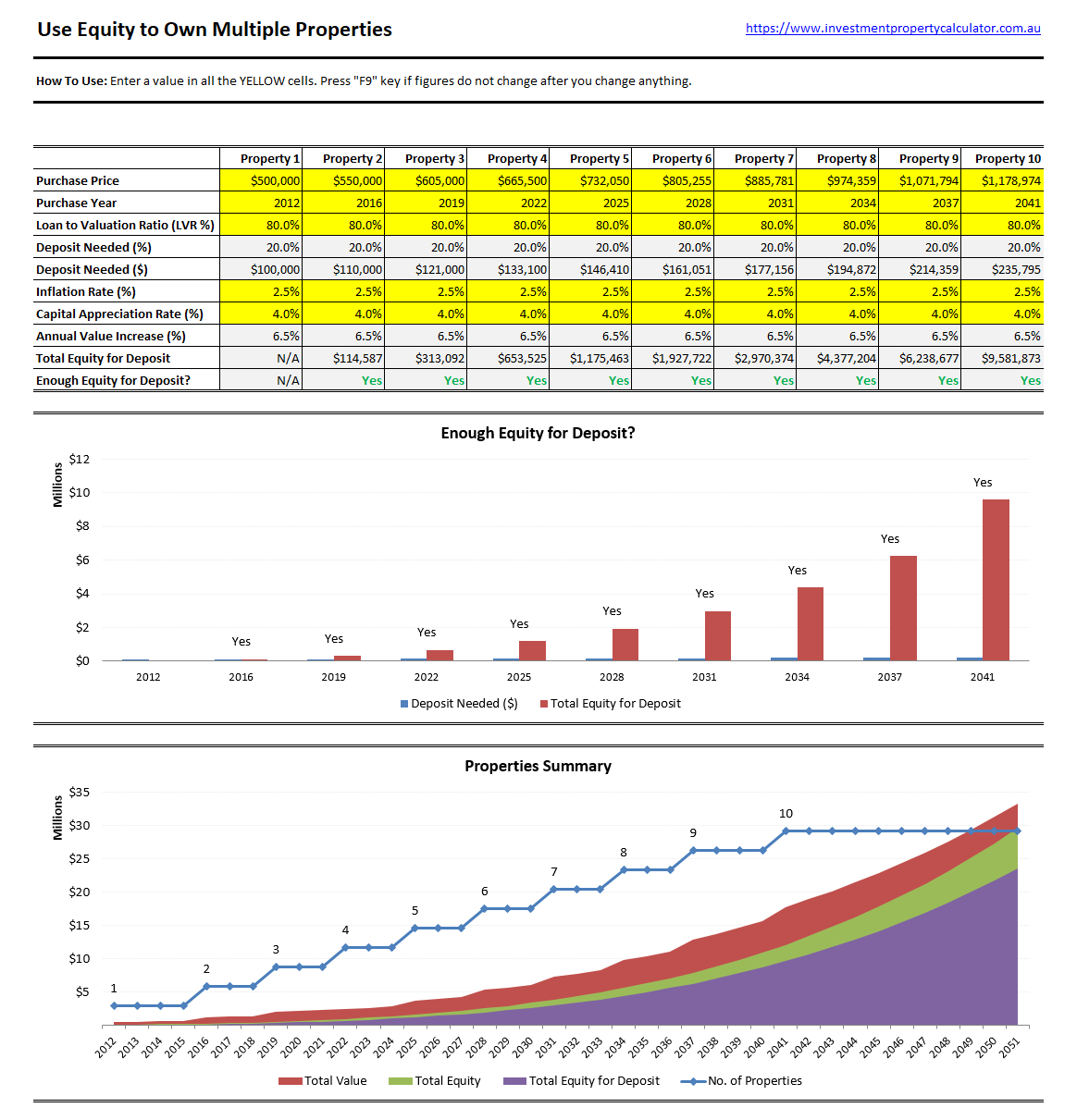

This Use Equity to Own Multiple Properties Planning Tool will help you to understand if it is possible for you to purchase multiple properties using the equity in your existing properties.

Equity is the difference between the current market value of your properties and how much you owe on them. You cannot use all available equity because banks will typically lend you 80% of the value of your home. This means the equity you can use is 80% of total property value less the debt you still owe against it. This is considered your useable equity or accessible equity. Below is an example on how to calculate your property equity.

If we assume that your property is worth $1,000,000 and the current debt on your home loan is $300,000, then you have $1,000,000 - $300,000 = $700,000 worth of equity in your property. We can calculate your usable equity by 2 steps:

- (1) First we calculate 80% of your property value: $1,000,000 x 80% = $800,000;

- (2) Then we take the 80% of your property value and subtract your current outstanding debt: $800,000 - $300,000 = $500,000. This means you have $500,000 worth of usable equity which you can use to fund the deposit and other purchase costs including stamp duty and settlement fees etc. for another property.

This Use Equity to Own Multiple Properties Planning Tool helps you to plan how you can purchase multiple properties by using the equity in your existing properties. You can enter up to 10 properties. You can change LVR for each of the 10 properties. You can also define other variables such as inflation rate, capital appreciation rate etc.

Here is a screenshot that will give you a better idea that what you need to do and what this Use Equity to Own Multiple Properties Planning Tool can do for you.

Things You Need to Know

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Important Assumptions

Please note: This Use Equity to Own Multiple Properties Planning Tool is built based on the following assumptions.

(1) It is assumed that you will only use the equity gained through appreciation so the principal repaid is not considered as equity in this tool.