Overview

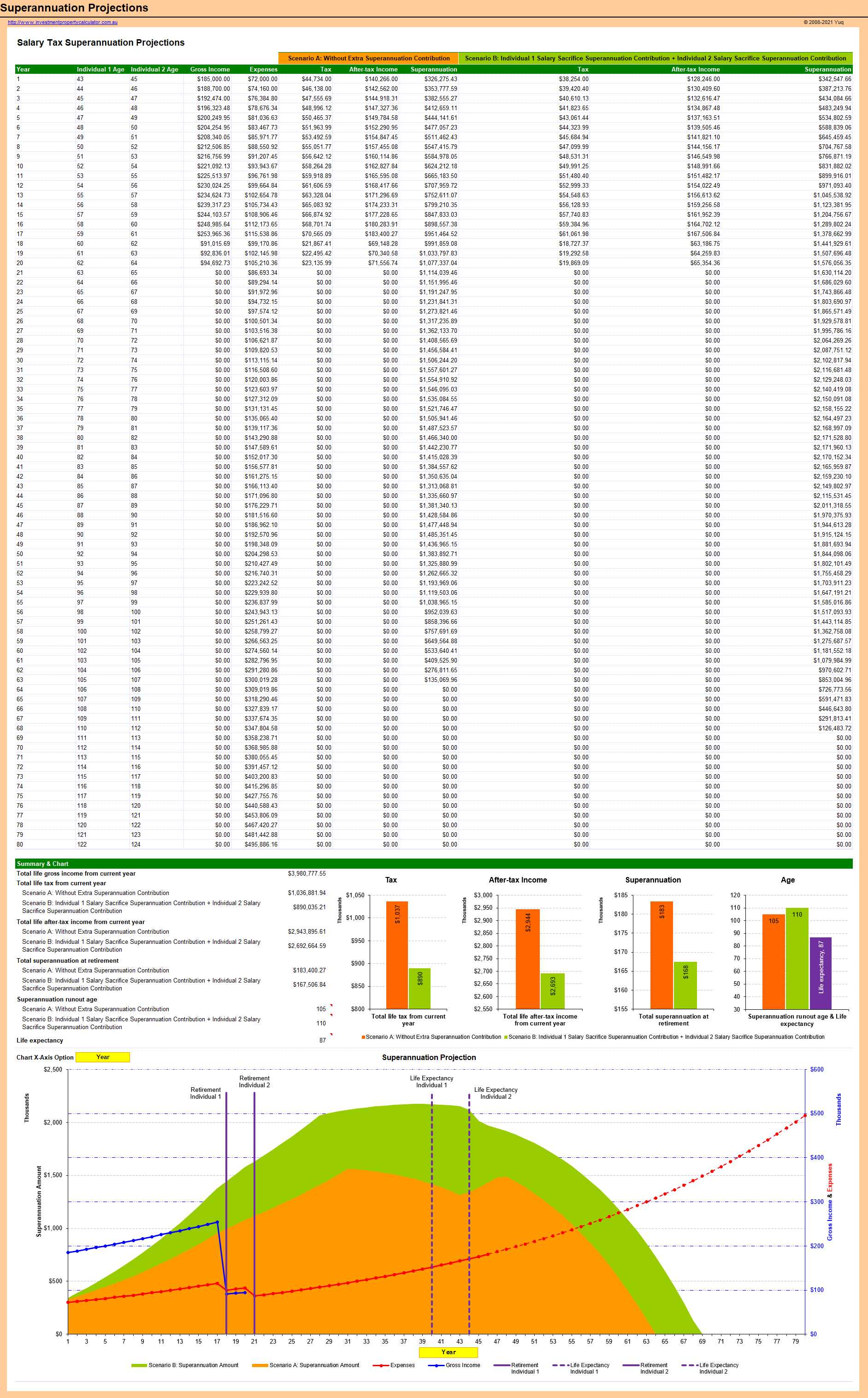

This Tax Salary Super Calculator for Couple will help a couple to plan their retirement by forecasting both superannuation and cash savings over 80 years.

Income tax, after tax salary, and superannuation are the most important components of our salary packages. There are some calculators for either income tax, or after tax salary, or superannuation. However, it is very hard to find one calculator that shows you all these three things together by considering important factors such as inflation rate, personal circumstance, life expectancy, retirement expectation, income projection, superannuation forecast etc. The Tax Salary Super Calculator is thus developed to give you an integrated view & forecast of your salary, tax & super all in one place.

Retirees around the world are at risk of running out of money, according to a report published by the World Economic Forum. Retirement account balances aren't increasing in line with rising life expectancy — and in Australia, that means male workers could outlive their savings by about 10 years, with that number increasing two to three years for female workers.

The Tax Salary Super Calculator is created to help Australians to understand the following without considering the government age pension:

- How much your superannuation balance will be year on year;

- How extra superannuation contribution can impact the superannuation balance long-term;

- How extra superannuation contribution can impact your tax and take-home pay;

- How long your superannuation can last after you retire;

- How it impacts your superannuation balance if you either spend less or you make more;

- The $1 million retirement myth.

Here is a screenshot that will give you a better idea that what you need to do and what this Tax Salary Super Calculator for Couple can do for you.

Things You Need to Know

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Important Assumptions

Please note: This Tax Salary Super Calculator for Couple is built based on the following assumptions.

(1) All months are assumed to be of equal length. One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.