Overview

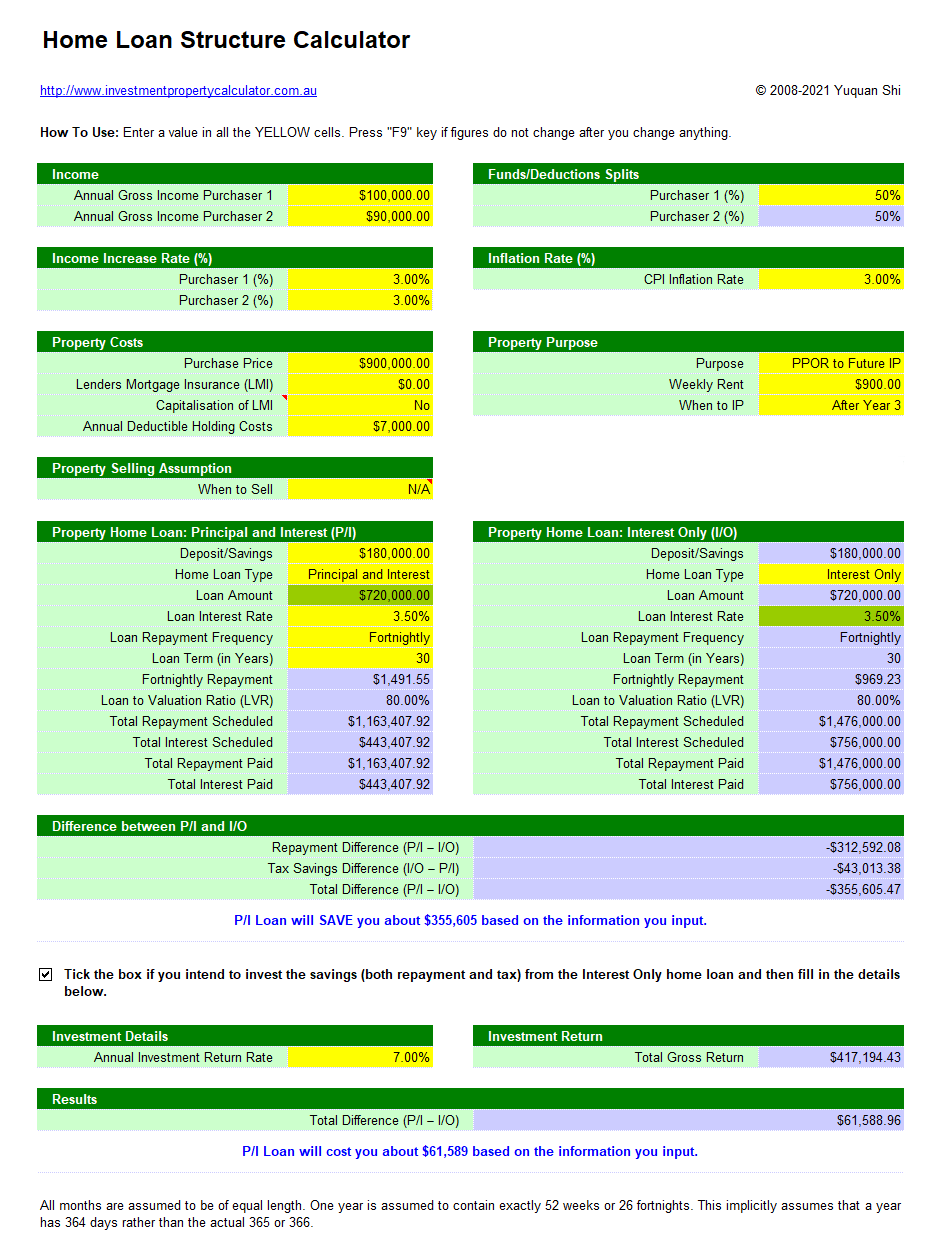

How will you choose between Principal & Interest (P/I) and Interest Only (I/O) repayment loan? This How to Structure Home Loan Calculator will show the repayment difference between P/I an I/O repayment loan by factoring in variables such as loan repayment frequency, purpose of the property (investment, PPOR, or PPOR to investment), and When to Sell the property.

You can use this calculator to create many different scenarios by adjusting variables including loan type (P/I or I/O), loan repayment frequency, purpose of the property (investment, PPOR, or PPOR to investment), timing to sell the property, and whether to invest savings from I/O loan.

Normally the scheduled repayment of a P/I loan is higher than that of an I/O loan for each term (no matter monthly, fortnightly, or weekly). This is becuase you need to repay the principal and interest if you choose a P/I loan while you only need to pay the interest for an I/O loan. This calculator allows you to see how they compare over the long term if you invest the repayment difference. You can adjust the investment return rate.

Here is a screenshot that will give you a better idea that what you need to do and what this How to Structure Home Loan Calculator can do for you.

Things You Need to Know

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it. You need to enable Macro in Excel so this tool will work.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Important Assumptions

Please note: This How to Structure Home Loan Calculator is built based on the following assumptions.

(1) All months are assumed to be of equal length. One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.