Overview

Do you know that you can make money from recycling your mortgage debt? First of all, a mortgage on your property should generally be considered a good debt.

Based on information from the Reserve Bank of Australia, Australia's total household debt now stands at $1,089 billion by September 2008 in real terms, that is about $52,000 for every Australian.

Most debt was incurred to buy houses. Debt for investor housing and debt for owner occupier housing were 27% and 59% of all debt in September 2008. Do you ever think that by recycling your home loan debt you can actually improve your financial position? If you have equity in your home or other assets you can borrow against the value of these to purchase investments such as managed funds and shares. The interest charged on these types of loans is tax deductible. This debt recycling strategy can help to reduce tax and generate investment income.

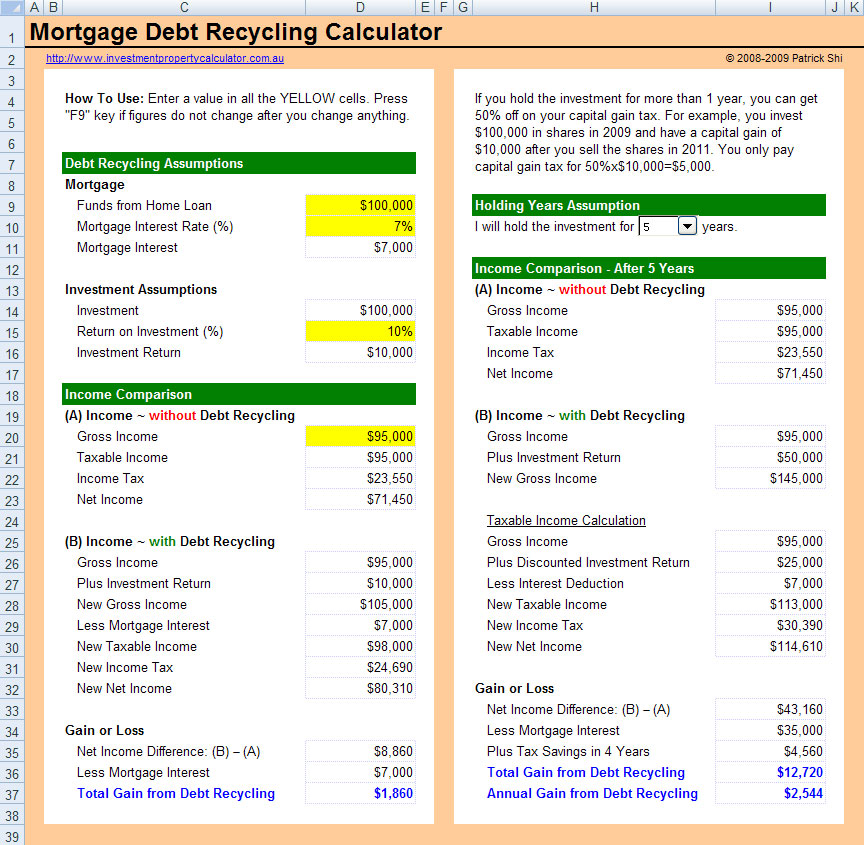

This free mortgage debt recycling calculator can show what kind of return rate you need to achieve in order to generate income and how much you can get if you decide to recycle your mortgage.

Here is a screenshot that will give you a better idea that what you need to do and what this Mortgage Debt Recycling Calculator Excel can do for you.

What Is Mortgage Debt Recycling?

Mortgage debt recycling is the process of moving non-tax deductible mortgage debt to tax deductible investment debt. Essentially, how debt recycling works is that you make extra payments to your mortgage, and then invest the same amount into an investment portfolio (for example shares). Debt recycling is a strategy that can help you pay down your mortgage, build an investment portfolio, and create a heap of tax deductions – all at the same time.

How Does Mortgage Debt Recycling Work?

Firstly you pay the money you are going to invest into your home loan account. Then you take that money back out and invest it. In doing so, you make the interest of that portion of your home loan tax deductible.

Secondly you keep paying extra to your home loan and continue to redraw that money to invest into income producing assets like shares.

Thirdly you can use the investment income, regular savings and tax savings to pay down your non-deductible home loan even faster to speed up this process.

The idea is to repeat this process until your investment loan entirely replaces your non-deductible home loan. Eventually you're left with just a tax-deductible investment loan.

An Example of Mortgage Debt Recycling

Let's have a look at a simple example of how Mortgage Debt Recycling works.

1. Ler's say your PPOR (principal place of residence, basically your home) is worth $800k with a $600k loan. The loan interest rate is 3% per annum. You have $190k in your offset account.

2. To make debit recycling work you split your home loan into two: a $400k loan and a $200k loan.

3. You pay the $190k in your offset account to the $200k loan.

4. You then take the $190k out and put it straight into your shares brokerage account to buy bank shares.

5. Now the interest on the $190k from the $200k loan is tax deductible as you invest in an income-producing asset (shares which will pay dividend).

If your tax rate is 37% this means you can have a tax savings of $190k x 3% x 37% = $2,109. If the shares you bought will have a 5% fully franked devident you will get $190k x 5% = $9,500. Hence in total you have a return of $11,609 by recycling your debt. If you just keep the $190k in your offset account you will be able to save $5,700 in interest. You should be able to see the potential difference between debit recycling and doing nothing.

If you want to understand more about debit recycling you can have a look at the ATO Community site. There are some good discussions in there.

Things You Need to Know

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Please note there is risk involved in borrowing against your home and risk associated with investing. Therefore, it is very important to consult your wealth adviser prior to taking any financial decisions.

You might also want to try the Free Investment Property Calculator if you want to invest on a residential rental investment property.

Download FREE Mortgage Debt Recycling Calculator Excel